The Comfort Intech share price trends provide valuable insights into the performance of the company’s stock over a specific period. Investors, financial analysts, and traders closely monitor these trends to make informed decisions regarding buying, selling, or holding onto the company’s shares. This article delves into the importance of analyzing Comfort Intech share price trends and provides a comprehensive overview of different factors affecting these trends.

Understanding Comfort Intech Share Price Trends

Importance of Share Price Trends Analysis

Analyzing Comfort Intech share price trends is crucial for investors seeking to understand the company’s financial health and overall market sentiment towards its stock. By examining historical share price data, investors can identify patterns, potential risks, and opportunities for future investment decisions.

Factors Influencing Comfort Intech Share Price Trends

Several factors can influence Comfort Intech share price trends, including:

-

Company Performance: Strong financial performance, revenue growth, and profitability can positively impact share prices.

-

Industry Trends: Changes in the industry landscape, technological advancements, or market demand can affect Comfort Intech’s stock performance.

-

Macroeconomic Indicators: Economic indicators such as GDP growth, interest rates, and inflation can impact overall market sentiment and, consequently, share prices.

-

Regulatory Environment: Changes in regulations or government policies can have a direct impact on Comfort Intech’s operations and stock performance.

Analyzing Comfort Intech Share Price Trends

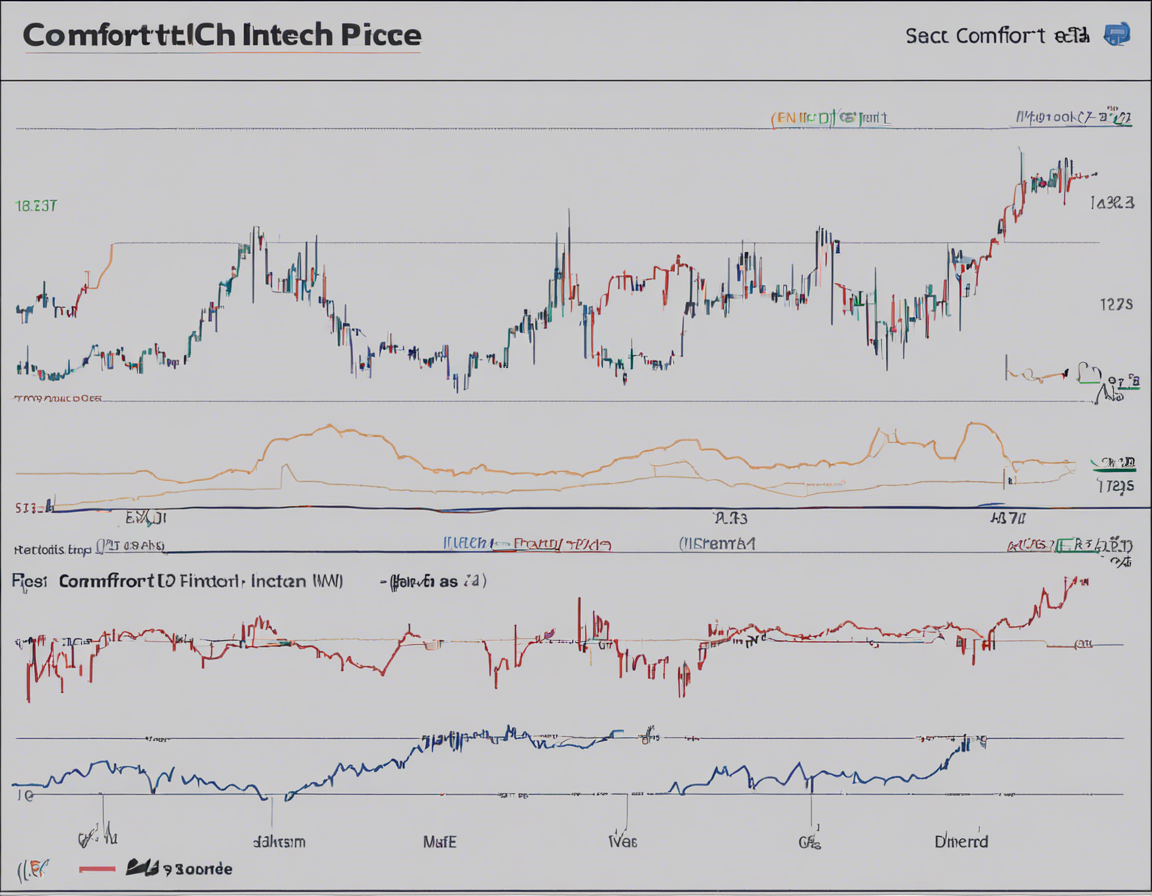

Technical Analysis

Technical analysis involves examining historical share price data, volume trends, and various technical indicators to predict future price movements. Key technical indicators used in analyzing Comfort Intech share prices include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Fundamental Analysis

Fundamental analysis focuses on evaluating Comfort Intech’s financial statements, industry position, competitive landscape, and growth prospects to determine the intrinsic value of the company’s stock. Key fundamental metrics include earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE).

Sentiment Analysis

Sentiment analysis involves assessing market sentiment, news, social media trends, and analyst recommendations to gauge investor perception and potential market reactions. Positive sentiment can drive share prices higher, while negative sentiment can lead to price declines.

Market Trends

Monitoring broader market trends, sector performance, and global economic conditions can also provide valuable insights into Comfort Intech share price movements. Understanding correlations between market indices, commodities, and currency fluctuations is essential for anticipating potential market impacts on stock prices.

Frequently Asked Questions (FAQs)

1. How can I interpret Comfort Intech’s stock price chart effectively?

Understanding technical indicators like moving averages, MACD, and RSI can help interpret stock price movements accurately.

2. What role do quarterly earnings reports play in determining Comfort Intech’s stock price?

Earnings reports provide insights into the company’s financial performance, revenue growth, and profitability, influencing investor perceptions and stock prices.

3. How do industry trends affect Comfort Intech share prices?

Industry trends such as technological advancements, market demand, and competition can impact Comfort Intech’s competitive position and stock performance.

4. What is the significance of volume in analyzing Comfort Intech share prices?

Volume indicates the level of market interest in Comfort Intech stock, with high volume typically accompanying price movements, signaling potential trend reversals or continuations.

5. How does market sentiment influence Comfort Intech stock prices?

Positive or negative market sentiment, influenced by news, events, and investor perceptions, can drive fluctuations in Comfort Intech stock prices.

In conclusion, analyzing Comfort Intech share price trends involves a holistic assessment of technical, fundamental, and sentiment factors to make informed investment decisions. By carefully monitoring these trends and staying abreast of market developments, investors can navigate the dynamic stock market landscape with confidence.